Youth Sports is Serious Business

An analysis of why investors love the youth sports business, why rollups & PE activity are hot, and where I see the next wave of growth opportunities.

I get nostalgic reminiscing on my little league baseball days. I think about long summer days, team bus rides, early close friends, and… private equity.

Wait, private equity?

That’s right. In 2024, we’re seeing a boom of private equity investment into youth sports.

For the longest time, American youth sports programs were largely run as nonprofits and mom & pop businesses. But recently, investors spotted a massive market.

In the US, 30 million kids participate in youth sports and 34 million parents pay – making up a $28 billion total addressable market.

$28 billion: that’s larger than major entertainment sectors, like the box office ($10 billion), recorded music ($11 billion), and online sports betting ($14 billion).

The massive market is also ripe for disruption. Youth sports are highly fragmented, minimally tech-enabled, and generally under-monetized – an investor’s dream.

So in the last decade (and especially the last year), investors began pouring money into leagues, facilities and the technology stack to manage it all. Now, nearly every generalist or consumer investor I meet says they’re interested in youth sports as an investment theme.

As the youth sports industry booms, I believe there are opportunities to create new billion-dollar companies. And I’ll explain why.

I broke this article down into three sections:

Past: A brief review of the youth sports industry’s dynamics

Present: How late-stage investors are strategizing around youth sports

Future: My predictions for the next venture-scale opportunities in youth sports

1. Past: A brief review of the youth sports industry’s dynamics

Extreme fragmentation has historically defined the youth sports industry.

Local schools, municipalities and nonprofits manage about half of youth sports participation. For-profit teams and leagues manage the other half of participation. But they largely operate as regional mom & pop businesses. Why?

It’s fundamentally difficult to scale a national-level youth sports business, for several reasons:

There are so many stakeholders. 25 thousand high schools, 60 thousand middle schools and over 1 million non-school-affiliated youth sports organizations all run their own operations.

It’s a labor-intensive, high-touch business. Have you ever tried coaching a little league team? It’s some logistics – and a lot of parenting & coaching. No technology or financial engineering can scale those two things.

Different sports have unique needs. For example, soccer generally receives school funding, whereas gymnastics generally runs through private gyms. Basketball has no shortage of courts, whereas hockey relies on limited ice rinks.

Different regions have unique needs. For example, an urban Manhattan league might be bottlenecked by court-time, whereas a rural Texas league might be bottlenecked by travel logistics.

As a result, few dominant national brands have emerged.

We can think of leaders in almost every entertainment & leisure category. Think sports leagues (NFL or NBA), TV/film (Netflix or Disney) or gaming (Nintendo or Activision).

But in youth sports, the few league operators that come to mind (like Little League or Pop Warner) lack dominant market share. And among the space’s dedicated tech platforms (like Hudl or TeamSnap), few are multi-billion dollar outcomes.

At the same time, youth sports have incredibly appealing business fundamentals.

The overall TAM is massive. The average family pays $883 annually for one child’s primary sport. Assuming 2 kids per family and 2 sports per kid, that’s over $3,500. That’s almost 5% of the US average household income. Furthermore, parents making $150K+ spend 83% more than the average on their children’s sports.

The customers (parents) are fiercely loyal. Research shows that youth sports is some of the last spending that parents pull back in the face of economic pressures. Parents are desperate to prioritize their kids’ physical & mental health and social development. Especially in 2024 when the alternative is kids playing on electronics.

The downstream benefits captivate brands. Youth experiences are top-of-the-funnel for a lifetime of consumer behavior. Playing a sport as a kid is a leading factor of a person’s fandom. That’s why the Big 4 leagues fund programs like NFL Flag, Jr NBA and MLB Play Ball. Also, brands like Gatorade and Nike know that if you win over kids, they can be loyal customers for the next 50+ years.

But these long-term tailwinds have existed for a while. So why did investors recently start diving in over the last decade?

First, the 2010s saw a surge of institutional investor interest in professional sports. As pro sports grew saturated, investors began looking downstream to college sports – and eventually youth sports. (Here’s my and my colleague's take on PE in college sports).

Second, the emergence of new overlaying technologies in the early 2010s, from streaming to cloud to mobile phones, enabled new businesses to emerge around youth sports.

These developments caused a historic surge of investor interest in the space.

2. Present: How late-stage investors are strategizing around youth sports

Investors started by looking at a breakdown of the youth sports market.

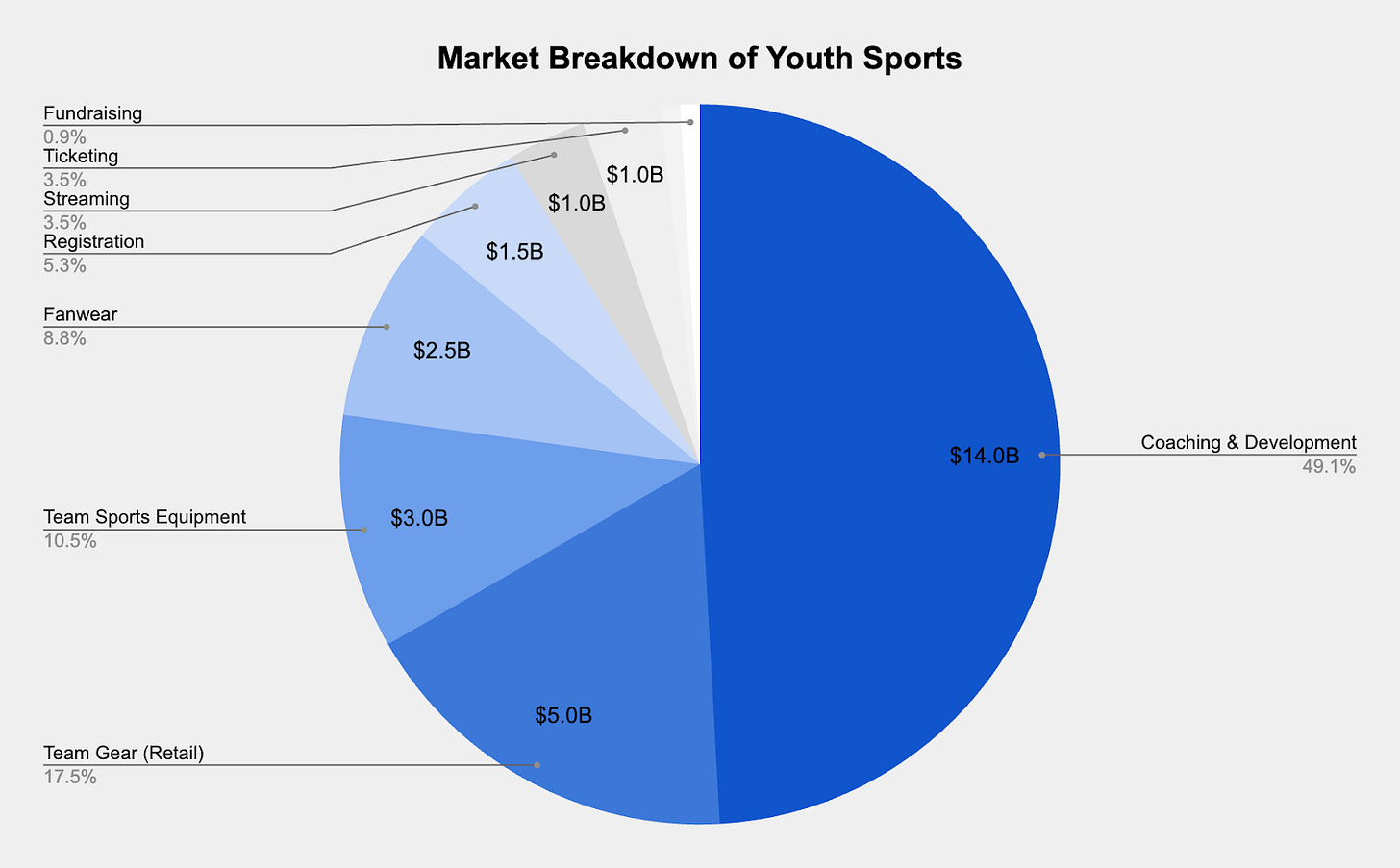

Approximately half the value lies in Coaching & Development. In other words, running teams, leagues, tournaments, facilities, and academies. The other half of value lies in “Everything Else.” From team merchandise to management software to streaming platforms.

Different investors have decided to pursue different halves of the pie – each with a unique investment strategy. I’ll explain both.

Strategy #1: HoldCos rolling up Coaching & Development businesses

In 2024, NBA / NFL owners Josh Harris & David Blitzer and The Chernin Group announced Unrivaled, a new vehicle to invest in youth sports assets.

According to their website, they’ve acquired 15 venues and league & tournament properties. That includes 6 action sports, 5 baseball, and 2 football properties.

Several other holdcos have taken a similar approach, acquiring Coaching & Development businesses. Perfect Game is the leader in baseball, running 9,800 events annually for 2 million kids. Varsity Spirit is the leader in cheerleading, and their parent company Varsity Brands recently sold to KRR for $4.75 billion.

This rollup strategy has two aims: vertical and horizontal integration.

Vertical integration is about preventing leakage in the value chain. Currently, youth teams pay to participate in leagues & tournaments which pay to host at sports facilities. Unrivaled and other rollups want to own that entire stack. It’s worth noting that more leverage comes from owning the facility / venue – think an IMG Academy or ESPN Wide World of Sports. Most of the revenue sits at that level, giving the facility owner leverage to negotiate with tournaments, teams and leagues.

Horizontal integration is about finding efficiencies across similar assets. Different camps, tournaments and facilities can share best operating practices, gain leverage with suppliers, cross-sell to customers, and reduce corporate overhead.

The long-term ambition of this HoldCo strategy is the following: If a kid grows up playing a sport, every team they join, every camp they attend, and every field they play on can be owned by one company.

Strategy #2: Private equity optimizing the Everything Else businesses

The second investment strategy has been to acquire “everything else” in youth sports – mainly the software businesses that service the Coaching & Development side of the business.

In the mid-2010s, major private equity firms began acquiring category leaders, for example:

In 2016, Genstar Capital acquired Stack Sports, which makes software to manage youth sports registration, communications, payments and other administrative needs.

In 2017, Bain Capital acquired BSN Sports, the largest distributor of youth sports apparel and equipment.

In 2022, KKR acquired PlayOn! Sports, a media platform for livestreaming youth sports games.

The rationale behind these investments is that youth sports are historically under monetized. PE can help grow these software businesses with a similar playbook they apply across industries: capital injections, financial engineering and operational changes.

In summary, these two investment strategies are underway: (1) HoldCos rolling up teams, tournaments and facilities, and (2) PE firms investing in software to service these businesses.

So, why does this late-stage deal activity matter to venture investors and entrepreneurs?

3. Future: My predictions for the next venture-scale opportunities in youth sports

I believe late-stage investment in youth sports matters to venture investors and entrepreneurs for two reasons:

Increased investment into youth sports means the market will continue to grow. Top-down research predicts the space will grow at a 9% CAGR, well beyond inflation. As youth sports experiences improve and become more monetized, new businesses will have a larger TAM to tap into.

Continued consolidation means it will be easier for businesses to tap into that TAM. Imagine a world where Unrivaled runs not 5 but 50 baseball camps across the country. A software solution’s GTM might have previously involved selling to every one of those 50 camps. But in the future, they could reach scale by signing one major deal.

Those dynamics pave the way for new businesses to emerge across youth sports. In particular, there are five verticals we’re particularly excited about at Will Ventures.

E-Commerce: Team gear, sports equipment and fanwear makes up over a third of the youth sports market. But legacy incumbents provide a less-than-ideal customer experience: selling via catalogs & sales reps, lacking modern e-commerce options, and offering limited product selection. Will Ventures was excited to lead the seed round for Youth Inc, which is building a DTC marketplace to modernize the youth sports merchandise experience.

Content: Multiple platforms livestream youth sports content, including GameChanger, BallerTV, and PlayOn. This content’s primary use case is parents watching their kids’ games when they can’t attend. The secondary use case is coaches analyzing the gameplay footage. But I believe current platforms sell short the entertainment use case. What if kids could curate their own SportsCenter, based on their own team and rival team highlights? What if kids could host a Twitch-style livestream for their best friend’s game? New capabilities like AI-powered commentary and clipping could enable these entertainment applications for the first time.

Customer Data: As more participation options emerge, youth sports properties must increasingly compete for customers – and customer data is a key component. To my understanding, some leading streaming platforms have tens of millions of registered users, but lack the organization or specificity to effectively monetize that data. There’s opportunity for new businesses to help aggregate, organize and leverage customer data across youth sports, potentially through marketplace or affiliate models.

Management & Administration: Multiple software solutions help coaches and league administrators manage their youth sports businesses. Market leaders like Team Snap and League Apps provide a range of services from registration to scheduling to website-building. There’s opportunity for deeper point solutions around specific verticals of the youth sports business. For example, Will Ventures invested in Players Health, which streamlines the insurance registration process for youth sports teams. Will Ventures also invested in Aktivate, whose newest product helps school sports programs manage fundraising. Other niche spaces that could be ripe for a dedicated software solution include sponsorship, ticketing, and facilities management.

Travel & Logistics: A large portion of youth sports spending immediately exits the youth sports industry. It goes towards travel expenses like hotel, flights, buses and meals. Marriott or American Airlines is capturing all of that value. There's an opportunity for a youth sports-specific platform to broker these expenses and take a cut of the spend.

Those are just five of the verticals we’re interested in, as we closely track developments around youth sports. But we’re always looking to meet the best entrepreneurs building in the space.

If you’re building around youth sports, I’d love to hear your thoughts. Please reach out!

Great summary! The industry is definitely changing and evolving.

Have you looked at, or point me to, any trends around the impact to participation costs, quality/value of programming, increase/decrease of % of kids playing in programs, demographically changes of participants, etc. since the start of PE investment. Or do you have any thoughts on future trends of these.

Thanks for all your work and insights.

I have been watching my grandson play on GameChanger (owned by Dick’s Sporting Goods!) for a couple of years now and had no idea about the pervasive investment into youth sports - really good overview. With PE investment, do you see the consolidation of many of the streaming services like other investments - into a larger entity in the near future, or is it so fragmented that this will be difficult?