What the NBA sees in Latin America

As the NBA explores a Mexico City franchise, we see a LATAM sports industry primed for growth, and room to build the region's own Fanatics, DraftKings and Ticketmaster

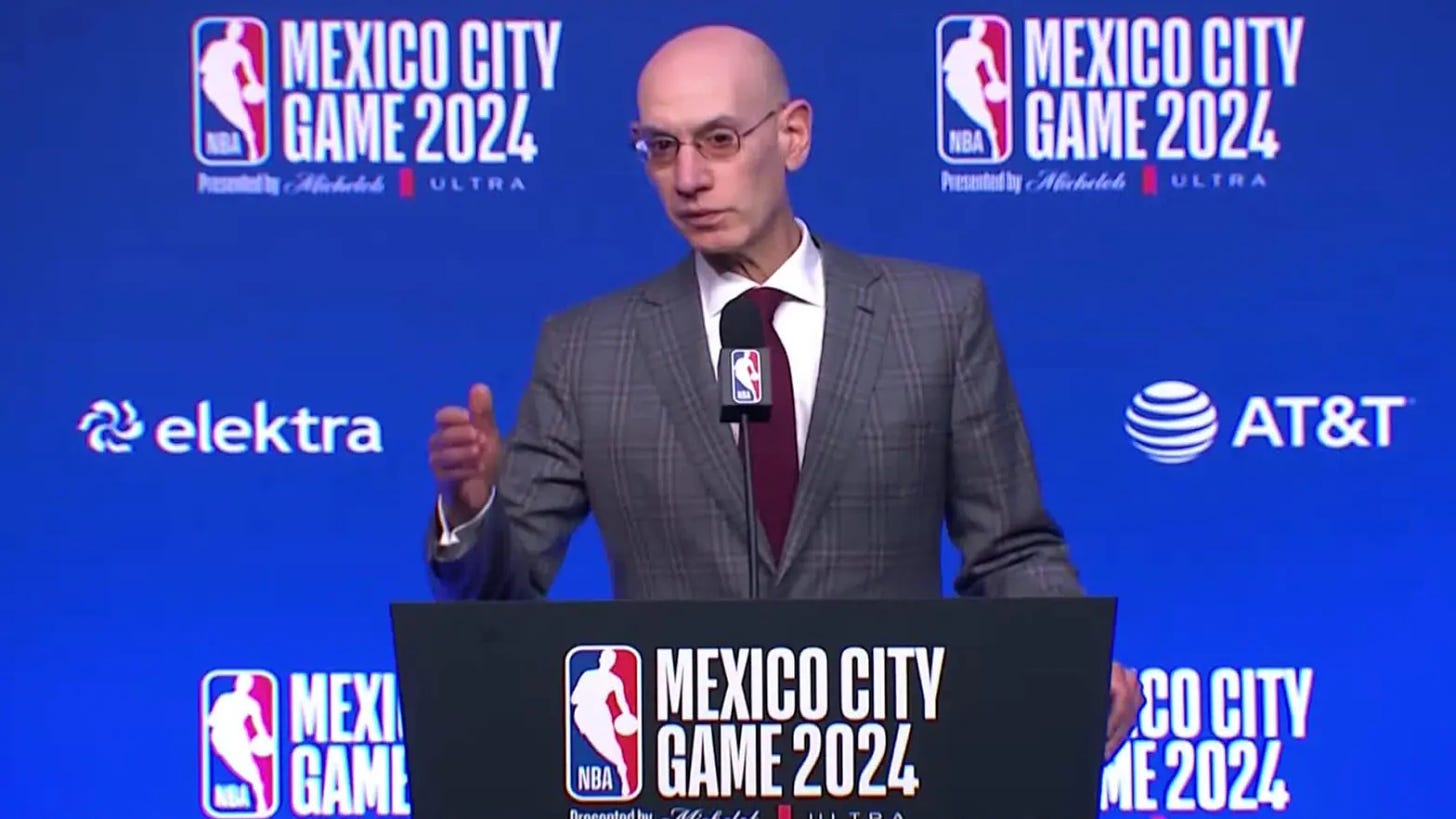

At the NBA Mexico City Game last week, Adam Silver sat courtside with a cousin of Carlos Slim Helú, Mexico’s richest man.

The family’s reportedly interested in bringing a franchise to the city – and at his press conference, Silver commented on the prospect of a Mexican NBA expansion team.

“It’s highly unlikely Mexico City would jump above U.S. cities that are currently under consideration,” Silver said.

But he then switched his tone, “In many ways, Mexico City would be more additive. Flipping a switch in a country of 130 million people and 22 million people here in Mexico City. And so not just from a business standpoint, but in terms of generating more interest and enthusiasm around the game. So we’re going to continue to study it.”

The commissioner’s comments supported what many insiders suspect about a Mexican NBA franchise.

For the expansion round currently under discussion, Las Vegas and Seattle are the clear frontrunners. But the next time the NBA considers expansion, Mexico City could top the list. Notably, in 2021 the NBA brought a G League franchise to Mexico City, partly to get smart on the market.

The NBA isn’t the only US league interested in monetizing Latin American fans. In September, the NFL hosted its first game in Brazil, after years of games in Mexico City. In March, MLB hosted its first games in the Dominican Republic, after years of games in Mexico City and Monterrey.

The Big 4 leagues are all captivated by the same selling points: a region of 730 million people, who are obsessed with sports and have increasing internet access, all in similar time zones and close proximity to the US. If the leagues grow their own fanbases in LATAM, they know they can drive meaningful media and sponsorship dollars.

But at Will Ventures, we see whitespace well beyond the Big 4 leagues’ growth in LATAM.

LATAM has some of the world’s most passionate sports fans. Yet the sports industry lacks many basic building blocks to engage and monetize those fans.

We believe there’s an opportunity to build Latin America’s own versions of Fanatics, DraftKings, Ticketmaster, and other unicorn sports businesses.

It’s worth stating that LATAM is far from a commercial or cultural monolith. All 33 countries have their own professional sports leagues, their own dominant media and sponsorship partners, and their own unique consumer preferences.

For example, many Latin American startups treat Brazil, the region’s largest market, with a totally different go-to-market strategy from the rest of Latin America – given the language barrier, cultural nuances and government regulations.

That said, most Latin American countries share one thing: a wildly passionate sports fanbase.

90% of internet-connected Latin Americans report watching one or more sports online, and 50% say they’re interested in playing sports. Both figures are well above global averages.

LATAM fans wear that passion on their sleeves. Check out footage from Argentina’s Superclásico matchup between Boca Juniors and River Plate. The atmosphere at La Bombonera makes Cameron Indoor or the Big House look like child’s play. In 2013, Argentina’s Primera División actually banned opposing fans from stadiums after too many deadly interactions.

But compared to US fans, LATAM fans are undermonetized.

Compare sports revenue per capita in the US vs Brazil, the region’s largest economy.

To give a more granular datapoint: In 2023 the median Brazilian Serie A team drove $87 million in revenue. The median NFL team drove $550 million in revenue.

Higher household income in the US is a large part of the story here.

But the other part of the story is: LATAM lacks many building blocks of the sports industry that exist in the US. We’ll highlight three categories – merchandise, betting and ticketing – and explain where we see opportunities to build major sports businesses in LATAM.

#1: Merchandise

You’re bound to see far more sports jerseys walking around Rio de Janeiro or Buenos Aires than New York or Los Angeles.

But compared to the US, LATAM licenseholders only capture a small portion of the demand for official merchandise.

In the US, Fanatics has built a $31B business by consolidating the official sports merchandise market. Fanatics owns exclusive licenses across the major leagues, controls their e-commerce platforms, and manages distribution. In the US, brands – large like Nike and small like Mitchell & Ness – invest in marketing and ensure wide distribution.

As a result, American fans can easily purchase licensed sports merch. Latin American fans don’t have the same luxury.

Major brands like Nike and Under Armour don’t have corporate offices in LATAM. Rather, they operate through distributors such as Grupo Axo and Grupo SBF. This helps them navigate local needs, reduce operational costs, and mitigate economic risk. But this also boosts retail prices and reduces brand marketing spend – which leads to fewer sales.

Some leagues have tried to capture demand by setting up a network of retail stores with the help of local operators. For example, the NBA has over 30 NBA Stores across Brazil (compared to just one in the US). But retail alone can’t drive the volume of an e-commerce platform.

Last year Fanatics purchased Fexpro, a Panamanian wholesaler with NBA, NFL and MLB licenses. But Fanatics has otherwise been less aggressive in LATAM, likely for a couple reasons. As Fanatics explores going public, it’ll be more conservative investing off its balance sheet. For now, Fanatics has chosen to prioritize the larger European market, where it’s recently inked partnerships with UEFA, the English FA, and multiple Champions League clubs.

There are several reasons no Fanatics-scale aggregator has emerged in LATAM:

Varying tax laws and import/export regulations across countries complicate cross-border business.

Counterfeit products flood the market, reducing demand for officially-licensed merchandise.

Household income is lower, so fewer fans can afford an official jersey for $100, especially when adding in shipping & handling.

The Fanatics of Latin America wouldn’t necessarily look like Fanatics in the US. The platform might index less on jerseys and more on lower-priced items. The platform might also have to integrate with other aspects of the fan experience such as ticketing, in order to incentivize fans to buy official and not counterfeit merchandise.

But LATAM consumers are shifting to e-commerce, on a roughly 5-10 year delay from US consumers. Whoever can navigate cross-border regulations, figure out distribution networks and aggregate licenses will have a huge opportunity to monetize sports fans via merchandise.

#2: Betting

Sports betting is another space with room for innovation in LATAM.

The US is a relatively mature market, with DraftKings and FanDuel owning nearly 70 percent of the market. Americans know that if they’re in a legal state, they can choose from a number of household name sportsbooks.

But LATAM lacks any dominant panregional betting platform. Instead, smaller operators dominate individual countries, for example Caliente in Mexico and Wplay in Colombia. See here how betting volume is fragmented across LATAM’s six largest markets.

No LATAM company has achieved DraftKings or FanDuel’s scale for several reasons.

First, varying government regulations – around taxes, license acquisition, and payment processing – make it difficult to grow across borders. For example, Brazil mandates bank transfers for withdrawals and bans cash, checks, and cryptocurrency. Meanwhile, Mexico and Colombia permit credit and debit cards. Sportsbooks need boots on the ground and localized expertise to navigate these complexities.

Second, consumer behaviors differ across markets. Sports bettors in different countries get acquired via different advertising channels and also bet on different domestic leagues. For every new market, sportsbooks need to implement wholly new marketing strategies and acquire new data licenses.

Given these barriers to cross-border growth, we see two scenarios that could unfold in the market:

A large international gambling operator such as a Bet365 or Flutter acquires a significant portion of smaller sportsbooks across LATAM to gain market share.

A startup develops a superb product, gains hold of one market, and raises capital to hire localized compliance and GTM experts – and incrementally expand across geographies.

We’re more bullish on the second scenario – because we believe consumers will turn towards the best product experiences.

One case study for the second strategy is Draftea in Mexico. They’ve raised over $30 million to build a superb fantasy sports product – and they’ve taken market share from Mexico’s incumbent, Caliente. We’re excited to see how they take their product-centric approach and expand across new geographies.

In the US, betting startups have become a popular category for blue-chip VC funds. But LATAM has seen less VC activity around startups like Draftea. We see whitespace for more product-focused startups to develop great betting experiences and eventually expand across geographies.

#3: Ticketing

Lastly, we see LATAM’s ticketing market ripe for disruption.

In the US, where Ticketmaster controls 70% of the live events ticketing market, digital ticketing has become the market standard. This gives fans a more seamless experience buying tickets and entering the arena.

In LATAM, ticketing is an even larger piece of the revenue pie for teams because media and sponsorship deals are smaller. But the fan experience for ticketing is a major pain point.

Incumbents like Ticketmaster, StubHub, Tuboleta and others don’t provide digital ticketing. Instead, many fans must pick up tickets at will-call whether purchased online or with cash. The incumbents also generally offer outdated products, providing limited flexibility and functionality for customers.

As a result, teams also lose out because the ticketing platforms can’t share customer data with event organizers. Without this fan data, teams are less empowered to sell merchandise, ads and other content to fans – and this makes teams even more dependent on ticketing as their main revenue source.

Will Ventures invested in Fanki, a next-gen ticketing platform for LATAM. Fanki digitizes the ticketing process, making the experience simpler for fans. And because Fanki requires fans to download their app and purchase tickets with their Fan ID, Fanki can deliver that data to sports teams, which use that data to further optimize the fan experience.

Fanki has already partnered with first-division soccer clubs in Colombia and Mexico. The fact that they’ve gained market share so quickly points to the overall demand for better product experiences among the region’s sports fans.

##

So, will the NBA bring a franchise to Mexico City? We’ll likely have to wait several years to see.

But in the meantime, Latin America’s sports industry has significant room for growth. There’s whitespace to build LATAM’s own Fanatics, DraftKings, Ticketmaster. As these businesses emerge and the sports ecosystem develops, the NBA and other Big 4 leagues would be remiss to not seriously consider bringing a franchise to the region.

If you’re building or investing in sports businesses in Latin America, please reach out. We would love to hear your thoughts on LATAM’s merchandise, betting and ticketing sectors – and also learn what areas you’re most excited about.

Amazing work, couldn’t agree more with the content specially the merchandising opportunity in LATAM. I would add the need to have more world class arenas/stadiums in the region. One quick comment: Ticketmaster Mexico already offers electronic tickets that you can either save in your phone wallet or transfer to other people through the app.

I left you a message on Linkedin.

PS: This edition is the best since I started following you about a month ago