Is The Sports Betting Gold Rush Over? (Part I)

We explore why VCs flocked to invest in sports betting, why investor sentiment then cooled, and why we believe new billion-dollar companies will emerge in the space

In 2018, US sports betting was legalized. In 2024, it already feels inescapable.

Follow LeBron James? He stars in DraftKings commercials.

Listen to Bill Simmons? He plugs FanDuel promotions.

Watch the NFL? The league runs marketing campaigns with DraftKings, FanDuel AND Caesars.

To quote the Costco Guys, the US sports betting business is in boom.

39 states (and counting) have legalized online sports betting.

29 million Americans are now betting online.

$120 billion in sports bets were processed in 2023.

See here how betting handle has grown every year. 2023 handle was already 10x from 2019, the first full year post-legalization.

But as the industry balloons, many venture capitalists have started asking: Is the sports betting gold rush over for investors?

From 2017 to 2021, early-stage investment in sports betting startups grew 9x – compared to 3x across all industries per Pitchbook.

Betting’s legalization coincided with a larger tech boom. So VCs rushed to capitalize on legalization and fund new betting concepts, from the sportsbook Betr ($105 million raised to date) to the daily fantasy game Sleeper ($67 million) to the peer-to-peer exchange Sporttrade ($46 million).

Then in 2023, the larger VC market contracted, as did investment in betting startups. But whereas the larger VC market quickly rebounded with generative AI, sports betting investments haven’t yet recovered.

Entering 2025, many VCs remain hesitant to invest in sports betting startups for reasons we’ll explain below.

But at Will Ventures, we remain firmly excited about sports betting – because we believe there are opportunities to build new billion-dollar businesses.

In this article, we’ll dive into sports betting platforms. In part two (here), we’ll explore betting-adjacent opportunities.

Investors are hesitant about B2C sports betting companies for several reasons.

First, investors fear there’s a ceiling on organic growth. Only 11 states remain candidates to legalize online sports betting. Texas and California are both massive markets. But even if all 50 states legalize, there’s arguably a limited universe of sports fans who want to bet.

Second, investors see regulatory risk. After the Supreme Court struck down PASPA in 2018, states rushed to regulate their markets. Regulators cobbled together licensing, compliance and consumer protections legislation quickly. As the betting industry grows, regulators are playing catch-up around key issues.

Two prominent issues are daily fantasy sports (DFS) and sweepstakes. DFS apps let users draft teams of athletes and compete for prizes based on their performances in a single day or week. Sweepstakes apps let users place wagers with virtual currency, which they can cash out for real money.

Both DFS and sweepstakes feel a lot like sports betting. But because of legal loopholes, both categories require no license to launch in 40+ states. That’s why startups like Underdog Fantasy, PrizePicks and Fliff have emerged.

But in both categories, there’s risk of major states like California and Texas legalizing sportsbooks and cannibalizing their audiences. There’s also risk of legal betting states cracking down on DFS and sweepstakes. Earlier this year, Florida sent cease and desist orders to Underdog and PrizePicks.

Lastly, investors see a brutal competitive landscape for B2C betting platforms. FanDuel and DraftKings own nearly 70 percent of the US market. Add Caesars and BetMGM, and the top four incumbents own 90 percent of online sportsbook revenue. The market is an oligopoly.

These incumbents have daunting moats that limit new entrants. Here’s a sampling of what a new sportsbook would need to do in order to compete at scale:

Go state-by-state paying lobbyists and purchasing sportsbook licenses.

Buy data from providers like Sportradar, and build in-house models to price lines.

Build a fully-functional digital product capable of hosting millions of users.

Invest tens (or hundreds) of millions in marketing campaigns to acquire users.

Every step is highly capital intensive, especially marketing. Why? Sportsbooks are relatively commoditized products, all offering similar odds and UI/UX. So most users turn to whoever has the best promos and brand awareness. Or often, whichever app they downloaded first.

FanDuel and DraftKings each spend around $1 billion annually in marketing. In 2023, both actually began scaling back their marketing in their march towards profitability. But still, FanDuel and DraftKings are uniquely well-positioned to offer promos like “$200 in free play for new customers” – a strong incentive for new bettors to choose their platform versus others. So even legacy brands like ESPN Bet and Fanatics Sportsbook have struggled to compete.

“Rich-get-richer” is the prevailing market dynamic. That scares many investors from backing new entrants.

But at Will Ventures, we’re excited about new B2C betting platforms for two reasons.

Reason #1: The incumbents will not satisfy all consumers.

37 million Americans will bet on sports online in 2025. No single brand or product can satisfy all those consumers.

Currently, major sportsbooks’ brands appeal generically across all sports fans. And their products appeal best to experienced bettors. Many casual and young bettors consider the UI/UX and betting lines intimidating, like Excel spreadsheets.

This product strategy makes sense because sportsbooks drive the bulk of revenue from avid bettors (aka whales or VIPs). This is a very small percentage of players who bet large amounts through defined strategies, and don’t have a huge appetite for new products.

But as a result, many demographics – from Gen Z to women to casual sports fans – don’t resonate with the brands and products of leading sportsbooks. 72 percent of Americans say they are sports fans, but fewer than 10 percent bet on sports. Evidently, the incumbent sportsbooks are missing out on large audiences.

Reason #2: The incumbents will drive successful exits via M&A.

The incumbents are not just operating sportsbooks. They are building multi-product suites across betting and real money gaming.

For example, in addition to its sportsbook, DraftKings offers online casino, daily fantasy, horse racing and free-to-play games based on the state. But DraftKings – with a $21 billion market cap and 4,000-plus employees – cannot possibly build every single product better than a lean startup can.

That’s why M&A activity is on the rise. Since 2022, DraftKings has acquired the online casino Golden Nugget for $1.56 billion, the online lottery business Jackpocket for $750 million, and the microbetting specialist SimpleBet for nearly $200 million.

Emerging betting platforms with strong brands and user bases will be appealing acquisition targets for incumbents growing their product suites.

So, where do we believe new generational sports betting companies will emerge?

We’re particularly excited about four whitespaces:

Social & gamified experiences

New audiences & demographics

Online casino

International

1. Social & gamified experiences

It’s worthwhile to compare the leading sportsbooks vs the leading mobile games.

Candy Crush, Clash Royale and other mobile titles are more social, gamified, and visually attractive than sportsbooks – and that helps them appeal to larger audiences. 164 million Americans play mobile games, about 5x the number of American bettors.

Betting products can emulate mobile games by leveraging many of the same social and community mechanics. Arguably the best part of sports betting is bragging to your friends when you hit a wild parlay (while conveniently staying quiet about your losses).

Sleeper is a great example of a social betting product. Sleeper launched as a pure-play fantasy sports platform and therefore prioritized community from the start. Sleeper then added DFS and real money functionality, but kept a central message board and social feed. Even users who aren’t actively betting often return to the app just to engage with friends.

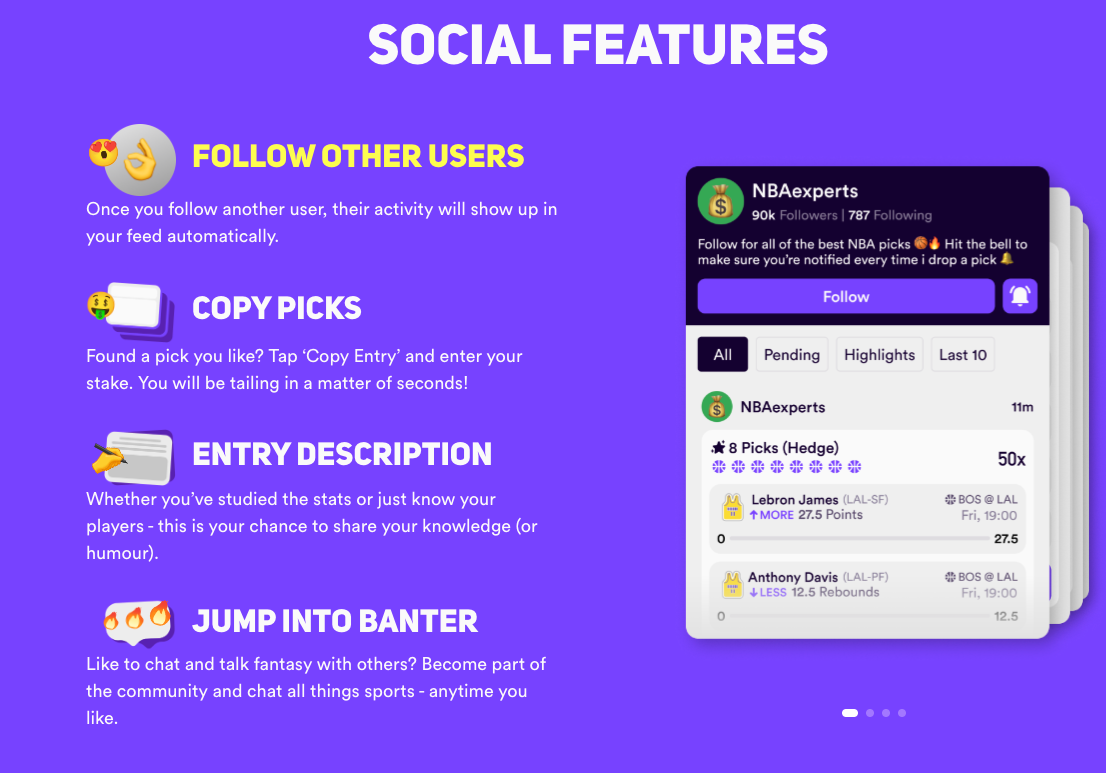

Another case study is Dabble, an Australian startup that launched a DFS product in the US last January. Dabble lets users follow others, copy picks, share their own bets, and chat with others. Thanks to these features (shown below), Dabble has quickly surged to a top-10 sports app on the iOS App Store, despite minimal marketing spend.

Nevertheless, there is no dominant social betting platform that harnesses network effects and locks in users as effectively as the major social media platforms.

In addition to social features, betting products can also benefit from gaming mechanics. Here’s a great essay by Robin Guo from a16z, which explains how Duolingo leverages features from leaderboards to streaks to likes/shares and more. Every betting product incorporates some of these. For example, Fliff has leaderboards that show players how they stack up against their friends.

But as the vast mobile games industry reflects, there are near-limitless ways to gamify an app – and we’re confident that many gaming mechanisms have not been fully tapped for betting. As an example, it’s an interesting exercise to ask: How could short-form video – the dominant force in today’s digital products – be incorporated into betting products?

2. New audiences & demographics

Betting products also have an opportunity to reach new audiences beyond core bettors.

Gen Z has driven the most innovation to date. Gen Z grew up with sleek, engaging digital products – not the spreadsheet-like interfaces of sportsbooks. By combining social & gaming mechanics, vibrant & user-friendly interfaces, and targeted marketing, startups like PrizePicks and Fliff have captured massive young userbases. On college campuses, you might hear students express more brand affinity for Fliff than FanDuel.

Casual bettors have also been a target for startups. PrizePicks and Underdog have reached these casual users by simplifying betting. Instead of overwhelming users with traditional odds formats (e.g. -/+110), these platforms present bets in an intuitive, visually engaging format. For example, a user might be prompted to predict whether Luka Doncic will score over or under 28.5 points, with clear multipliers displayed (e.g., over: 1.34x, under: 2.73x). The bright, colorful design and straightforward "yes or no" options make the experience accessible and enjoyable to non-core bettors.

As each generation and demographic brings unique preferences, the challenge becomes identifying the design mechanisms and product experiences that will resonate most. This opens the door for audience-specific innovations in sports betting. We’re curious how more audiences like females and Gen Alpha will be engaged by new products.

3. Online casino

FanDuel, DraftKings and other sportsbooks aren’t just interested in sports betting. They have ambitions across real money gaming.

Online casinos – think virtual poker, slots and roulette – are a large segment. Online casinos are a $17 billion global market, about 20 percent of the sports betting market. But online casinos are significantly more profitable than sportsbooks, and many more markets have yet to legalize.

That’s why DraftKings, FanDuel and BetMGM operate online casino products in the seven US states where they’re legal. Each is interested in cross-selling users from their sportsbooks to their online casinos given the higher ARPU. Other real money gaming products that drive high margins are lotteries, skill-based games and live dealer games.

Domestically, legalization will move slower for online casinos than for betting – because there’s weaker societal support and more special interest opposition. But internationally, there are massive legal markets such as Australia, Canada, Brazil and much of Western Europe.

Cryptocurrency-based casinos are a particularly interesting subset of this market. Stake – the leading crypto casino which notoriously sponsors Drake – drove $2.6 billion in revenue last year. Crypto adds value because it offers holders utility for their crypto, it facilitates payments more efficiently, and it reduces tax burdens.

Despite the massive market, both the traditional and crypto online casinos are in need of innovation. Many casinos purchase the same off-the-shelf games from content suppliers – making for an undifferentiated product experience. Also, casinos rely on inorganic marketing channels such as affiliate marketing and don’t reach many consumers.

For these reasons, Will Ventures was excited to back BetHog, a new crypto-based online casino and sportsbook founded by the co-founders of FanDuel. Launching initially outside the US, BetHog will develop original games as well as debut a first-of-its-kind feature allowing consumers to play alongside their favorite streamers. See below a screenshot of their beta.

4. International

Above, we laid out multiple opportunities across betting and real money gaming. All of these opportunities exist not just in the US, but also internationally.

International markets are particularly interesting because every region’s betting industry developed at a different pace. For example, Western Europe was the first region to liberalize gambling laws, so sportsbooks like Bet365 have long dominated the market. Contrastingly, the Middle East largely prohibits gambling, so free-to-play fantasy and trivia apps like Copa Fantasy in Saudi Arabia and Eksab in Egypt have gained more traction.

In less developed betting markets, startups with an understanding of local regions and user preferences can drive innovation and even unseat incumbents.

Draftea in Mexico is one example. The Mexican daily fantasy sports market was controlled by Grupo Caliente, an incumbent founded in 2016. Draftea raised $33 million, built a superb fantasy product, leveraged more modern branding, and gained significant market share. Rei do Pitaco raised $38 million to bring a similarly fresh fantasy product to the Brazilian market.

We believe more betting startups will follow Draftea and RDP’s lead, bringing innovation to underpenetrated markets.

-

In summary, we see significant whitespace to build the next great B2C sports betting and real money gaming experiences.

If building in any of these spaces, please reach out. We would love to meet you.

Read part 2 here, where we explore the ecosystem around sports betting platforms.